Ocampo´s view

After a decade of social and economic progress, Latin America is facing challenging issues

Not long ago, Latin America was a success story of economic growth. While advanced economies suffered a severe recession during the 2008–09 financial crisis in the United States and western Europe, followed by a weak recovery, emerging market economies were seen as the promise for renewed world economic growth. Latin America was viewed as part of that promise.

The 2004–13 decade was, in many ways, exceptional in terms of economic growth and even more so in social progress in Latin America. Some analysts came to refer to the period as the “Latin American decade,” a term coined to contrast with the “lost decade” of the 1980s, when a massive debt crisis sent the region into severe recession.

But this positive picture has changed dramatically. Growth per capita ground to a halt in 2014 and much of the region is again viewed with a sense of forgone promise. The sudden deterioration in the region’s prospects also reflects significant changes in the international factors that affect the region’s economic performance—including a substantial decline in commodity prices, which remain the backbone of the region’s (and particularly of South America’s) exports—and an overall moderation of global trade. If Latin America is to regain its footing, it must undertake reforms to diversify economies and to upgrade technologically its production structure to make it less dependent on the behavior of commodities.

Good performance

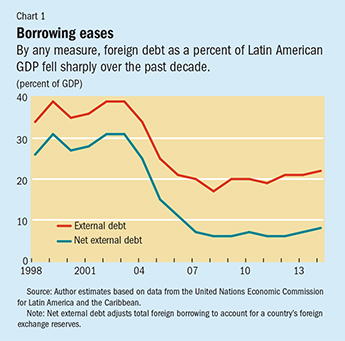

Although 2004 marked the start of the so-called Latin American decade, some economic improvements had begun years before. Low fiscal deficits have been the rule in most countries since the 1990s. A strengthening of the tax bases facilitated a well-financed expansion of social spending, which had severely contracted during the 1980s. Inflation, which for the region was nearly 1,200 percent in 1990, had fallen to single digits by 2001. These are all significant achievements. But the most remarkable one, given the precedent of the debt crisis, has been the sharp reduction in the ratio of external debt to GDP that took place during 2004–08. At the same time, countries in the region accumulated large foreign exchange reserves. External debt net of foreign exchange reserves fell from an average of 28.6 percent of GDP during 1998–2002 to 5.7 percent in 2008 (see Chart 1). Although the downward trend was interrupted in 2008, when the region ceased to run the current account surpluses it had been enjoying since 2003, it was still low by historical standards in 2014—only 8 percent.

Because low debt ratios make it more likely that a nation can pay its borrowings on time, they have permitted most Latin American countries extraordinary access to external financing. In the mid-2000s, real (after-inflation) interest rates on Latin American external borrowing returned to low levels the region had not seen since the second half of the 1970s, before the devastating debt crisis that led to the lost decade. Because of the prudent debt ratios, monetary authorities in several countries were able to undertake expansionary policies to counter the adverse effects of the strong recession in advanced economies. In particular, all major central banks reduced their interest rates, and several governments increased public sector spending to expand domestic demand. This ability to conduct economic policies that counteracted the business cycle rather than reinforced it was unprecedented in the region’s history.

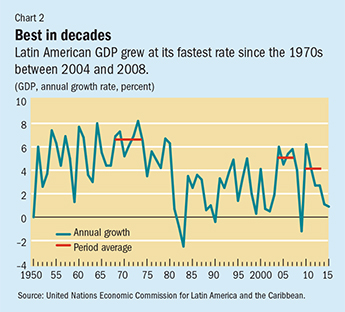

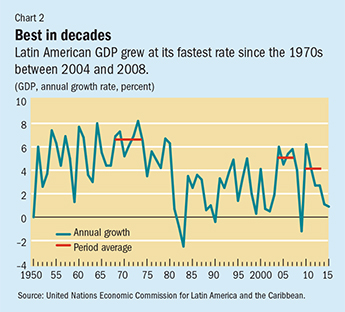

Economic growth averaged 5.2 percent from 2004 through the middle of 2008, the best the region had experienced since 1968–74 (see Chart 2). Moreover, it was accompanied by an investment boom in many countries. Investment as a percentage of GDP increased to levels that were only slightly below the peak reached prior to the 1980s debt crisis—and higher if Brazil and Venezuela are excluded.

And after a brief and sharp slowdown in economic growth in 2009—which was a full-blown recession in some countries, notably Mexico—growth recovered to average 4.1 percent a year in 2010–13. For most countries, the truly exceptional growth occurred from 2004 to mid-2008, although a few countries—Panama, Peru, and Uruguay—did experience a full decade in which their economies grew at average annual rates of over 6 percent from 2004 to 2013.

Since the 1990s, the region has also experienced long-term improvements in human development thanks to an increase in social spending as a proportion of GDP in all countries. The increased social spending facilitated the expansion of education, health, and other social services. These improvements can be characterized as a “democratic dividend,” because they followed the broad-based return to democracy in Latin America in the 1980s.

Most notable among the beneficial social changes during the past decade was a large reduction in poverty and related improvements in labor markets and income distribution. According to data from the United Nations Economic Commission for Latin America and the Caribbean (ECLAC) and the International Labour Organization, regional unemployment fell from 11.3 percent in 2003 to 6.2 percent in 2013. Employment in the informal sector—in which workers labor in low-productivity activities, either independently or in very small firms—fell from 48.3 percent of total employment in 2002 to 44.0 percent 2014, and the portion of the population aged 15 to 64 with jobs increased by 4.6 percentage points.

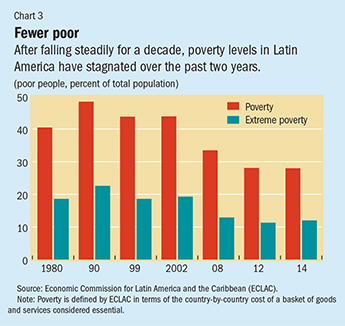

There was also a remarkable improvement in income distribution in most Latin American countries—not only a contrast with the region’s history, but also a divergence from the relatively generalized global increase in inequality in recent years (see “Most Unequal on Earth,” in this issue of F&D). This narrowing of inequality combined with economic growth resulted in a spectacular reduction in poverty levels and a rise of the middle class. In 2002, the percentage of the Latin American population living in poverty was higher than in 1980, according to ECLAC (2014) data. But the poverty headcount declined by 16 percentage points over the ensuing decade; about half of it represented a reduction in extreme poverty. The only comparable reduction in poverty levels took place in the 1970s, thanks to rapid economic growth at the time. As poverty fell, the middle class (people living on incomes between $10 and $50 a day, according to the World Bank definition) grew from about 23 percent to 34 percent of the population.

Still, these social improvements must be viewed with caution. Labor market informality still predominates in many countries. Improvements in income distribution were for the most part a reversal of the growing inequality during the 1980s and 1990s. And even with the improvements in inequality, Latin America continues to have among the worst income distribution in the world. Furthermore, the increase in availability of education and health care has not been matched by improvements in quality of the services. For example, Latin American students rank low in the Organization for Economic Co-operation and Development’sProgramme for International Student Assessment. High-quality education is essential to develop the technologically sophisticated areas that produce the high-value goods and services essential to a return to dynamic growth in Latin America.

Good times end

In contrast to the halcyon decade that ended in 2013, the recent economic performance of Latin America has been poor. Growth fell sharply in 2014 to just 1.1 percent—barely above the region’s current low population growth of 1.0 percent—and will continue at a similar or even lower rate in 2015, according to both the IMF and ECLAC (see Chart 2). Investment also declined in 2014, and will continue to do so in 2015. Poverty ratios have stagnated at 2012 levels (see Chart 3) and, although no hard data are yet available, this seems also true of income distribution. Unemployment has remained low, but the proportion of the working-age population with jobs fell in 2014.

There are, however, significant regional differences in recent developments in Latin America. The sharp slowdown is essentially a phenomenon in South America, which grew 0.6 percent in 2014 compared with 2.5 percent in Mexico and Central America. Furthermore, Venezuela started a severe recession in 2014, which will deepen in 2015, and the two largest South American economies, Argentina and Brazil, will also experience moderate recessions in 2015, according to the IMF (2015). Most other South American countries have continued to grow but experienced a slowdown in 2014 (Chile, Ecuador, Peru, Uruguay) or are experiencing one in 2015 (Colombia). The exceptions are Bolivia and Paraguay, which will continue to grow at 4.0 percent or more in 2015. In the northern part of the region, Mexico will grow, although at a somewhat lackluster rate—2.1 percent in 2014 and a projected 3.0 percent in 2015. That continues the mediocre pattern for the northernmost Latin American economy, which grew at an average rate of 2.6 percent between 2004 and 2013, the second lowest rate in Latin America. Thus, in northern Latin America, it is Central America (with the exception of El Salvador and Honduras) and the Dominican Republic that outperform.

Although some strengths remain, the region is less able than it was in 2008 and 2009 to counteract adverse external shocks, such as the decline in commodity prices or changes in U.S. monetary policy.

A major strength for the region continues to be low external debt ratios. Although they have started to increase, the debt ratios, net of foreign exchange reserves, remain low. With some exceptions, this favorable net debt position gives countries access to private capital markets and, at a minimum, permits most monetary authorities to avoid contractionary policies when managing the current shocks. But, because of rising external imbalances (especially a deficit in the current account) and in some cases rising inflation, the room for monetary authorities to maneuver is more limited than what they enjoyed during the 2008–09 financial crisis. Indeed, some—notably Brazil—have been forced to increase interest rates to counteract rising inflation. On top of this, higher government spending in recent years has constrained Latin America’s ability to use fiscal policy to support growth in economies hit by declining international demand. On average, the region has ceased to run the primary fiscal surpluses (income minus spending before interest payments) that it enjoyed before the crisis.

The greatest risk comes, however, from the current account of the balance of payments. Despite the very favorable terms of trade (export prices relative to import prices), the region has been running deficits on its current account (which largely measures the difference between exports and imports of goods and services, or equivalently how much aggregate spending exceeds the value of national income). One way to understand this is to subtract from the current account the gains in export values generated by improvements in the terms of trade relative to a pre–commodity boom year (2003). Estimated in this way, better terms of trade benefited Latin America at the equivalent of about 7 percent of GDP in 2011–13. But the region not only spent all those gains, it ran a current account deficit. This means that the region in fact overspent the commodity boom (see Chart 4). Other estimates (IMF, 2013) suggest even greater overspending. Recent depreciations of many of the region’s currencies will eventually help reduce current account deficits (by making exports more profitable and imports more expensive). But in the short term, improvements in the current account will come primarily from lower imports, the result of the economic slowdown.

Outside influence

The change in Latin America’s fortunes results in large part from a reversal of the benevolent external conditions that fostered the boom. The excellent performance from 2004 until the middle of 2008 reflected the extraordinary coincidence of four positive external factors: rapid growth of international trade, booming commodity prices, ample access to external financing, and migration opportunities and the burgeoning remittances that migrants sent home.

Two of these positive factors—migration opportunities and rapid world trade expansion—have disappeared, probably permanently, as a result of the financial crisis in advanced economies.

Migration opportunities to the United States are more limited than before the crisis, and high unemployment in Spain has prompted many South American migrants to return home. Remittances, which help prop up demand in recipient countries, have recovered but are still below the 2008 peak.

Likewise, world trade experienced the worst peacetime contraction in history after the September 2008 collapse of the Wall Street investment firm Lehman Brothers. Although trade swiftly recovered, since 2011 it has settled in at a slow rate of growth. Overall, according to IMF data, export volumes have increased only 3.0 percent a year since 2007, the worst performance since World War II and a fraction of the 7.3 percent annual growth rate registered between 1986 and 2007.

The commodity price boom took off in 2004 and, although the rise was interrupted by the sharp contraction in international trade, recovery was also very fast. The benefits of the positive terms of trade were particularly strong for energy- and mineral-exporting economies (Venezuela, Chile, Bolivia, Peru, Colombia, and Ecuador, in that order), followed by the major agricultural exporters (Argentina and Brazil). In contrast, oil-importing countries were hurt, notably those in Central America and the Caribbean.

But when non-oil commodity prices started to fall in 2012 and oil prices collapsed in the second half of 2014, fortunes were reversed. The recent losers have been the energy and mineral-exporting economies that benefited from the boom, while Central American countries are now winners. The economic slowdown in China is a major reason for the commodity implosion, as Chinese demand has been the major determinant of commodity prices. Unanswered is whether this is a short- or long-term phenomenon. My research with Bilge Erten (Erten and Ocampo, 2013) indicates that real commodity prices have followed long-term cycles since the late 19th century. If this continues to be the pattern, the world is at the beginning of a long period of weakening commodity prices.

Therefore, of the four conditions that fed the 2004 to mid-2008 boom, only one remains in place: good access to external financing. The reverberations from the Lehman collapse essentially shut down financing from private capital markets, but only for about a year. Latin American access to international capital markets rebounded sharply after that. Annual bond issues by Latin America have almost tripled—to $9.6 billion a month in 2010–14 compared with $3.5 billion in 2004–07—and the costs of financing have remained low for countries that issued bonds in international private capital markets. The favorable financing climate is the result of low debt ratios and the large amount of liquidity (cash) floating around global financial markets as a result of the expansionary monetary policies of major developed economies seeking to boost their still weak economies (see “Watching the Tide” and “Spill Over” in this issue of F&D). The euro crisis of 2011–12, the U.S. Federal Reserve’s gradual tapering of its bond purchases, and even the commodity shocks of 2014 have had only small effects on Latin America’s access to global financial markets. Moreover, the few countries that lack access to global private capital markets—Argentina, Ecuador, and Venezuela—have had ample financing from China. Global financial conditions may, of course, change given new uncertainties surrounding the euro area in the face of the Greek crisis or if a reversal of U.S. monetary policy draws away investment funds from the region. But at the time of writing, Latin America’s access to global capital markets remained favorable.

Going forward

Latin America cannot rely solely on favorable external conditions to propel economic growth in the near future, but must build up favorable conditions on its own. Hence the need for reforms.

But the reforms must go beyond traditional market approaches that were in fashion in the 1980s and 1990s. The stubborn fact is that market reforms have not delivered strong economic growth. Indeed, GDP growth during 1991–2014, after market reforms, was 3.2 percent a year, compared with 5.5 percent during the era of more active state intervention, from 1946 to 1980. Poor productivity has hampered economic performance, and the growth that has occurred has been unstable.

A basic explanation for this mediocre long-term economic performance is a lack of adequate attention to upgrading technology in the production sector, strong deindustrialization, and the fact that the region has specialized in goods (notably commodities) that offer limited opportunities for diversification and improvements in product quality. This has been reinforced by growing trade with China, which almost entirely imports natural-resource-based goods from Latin America. The net result of relying on traditional export opportunities is a wider technology gap, not only in relation to the dynamic Asian economies, but also with developed natural-resource-intensive economies such as Australia, Canada, and Finland.

It is essential, then, that the region invest in diversifying its production structure and place technological change at the center of long-term development strategies. This should include not only reindustrialization but, equally important, the upgrading of natural-resource-production technology and the development of modern services. Diversifying trade with China away from commodities is another essential element of this policy. The need to focus on new technology to increase competitiveness is critical given the prospects of weak growth in world trade.

But increased exports are not the only avenue the region should travel. Reduced poverty and a larger middle class provide opportunities for domestic markets as well. The best way to exploit richer domestic markets is through regional integration. But this requires, in turn, overcoming the significant political divisions that have blocked the advance of regional integration over the past decade. In particular, after strong growth in intraregional trade in the 1990s within the two major South American integration processes—MERCOSUR, which initially included Argentina, Brazil, Paraguay, and Uruguay, and the Andean Community of Bolivia, Colombia, Ecuador, and Peru—performance has been rather lackluster (see “Doing It Right” in this issue of F&D).

In macroeconomic terms, the most important condition for more dynamic production diversification is more competitive and less volatile real exchange rates. This should be part of a stronger shift toward macroeconomic policies to lean against booms and growth slowdowns and reduce the growth volatility that characterized the past quarter century.

The region also needs to make major advances in two other areas: the quality of education and infrastructure investment. Without better education, bottlenecks in the supply of well-trained workers will hold back the technological advancement the region needs. In turn, the weak infrastructure requires significantly higher investment in highways, ports, and airports—at least doubling current investment levels, according to the Development Bank of Latin America (2014). Such investments should make use of public-private partnerships but also—and even more—call for a larger injection of public sector funds.

This reform agenda must be put in place. It is not a question of market reforms—the meaning that “reforms” usually has in the policy debate—but of a better mix between states and markets. And, of course, that mix must also consolidate and advance social progress, the region’s most important achievement over the past decade. ■

José Antonio Ocampo is a Professor at Columbia University and Chair of the United Nations Economic and Social Council’s Committee for Development Policy. He is a former Under-Secretary General of the United Nations for Economic and Social Affairs, Executive Secretary of the Economic Commission for Latin America and the Caribbean, and Minister of Finance, Minister of Agriculture, and Director of National Planning of Colombia.

No hay comentarios:

Publicar un comentario